5 Key Metrics for Measuring Financial Health

As a business owner, you’ve poured your heart into your business. Long hours, late nights, strategic planning, and a relentless drive to succeed. But with the daily hustle, it’s easy to lose sight of the bigger picture. Are you truly on track for long-term viability? That’s where financial metrics come in – the quantifiable indicators that act as a health check for your business. By tracking these key numbers, you gain a clear understanding of your financial performance and identify areas for improvement.

Just as a sailor needs a reliable compass to guide them through the unpredictable waves, you need to rely on key metrics to assess your financial health. These metrics serve as beacons, illuminating the path to success and helping you steer clear of potential pitfalls.

Here are essential accounting metrics every small business owner should monitor to ensure their venture thrives.

- Profit Margin:

Your profit margin measures the percentage of revenue that translates into profit after accounting for all costs. A healthy profit margin indicates efficient operations, profitable pricing strategies, and how well you control costs. According to recent studies, the average profit margin for small businesses across various industries ranges from 7% to 12%.

- Cash Flow:

It measures the movement of cash in and out of your business over a specific period. Positive cash flow indicates that a business has more cash coming in than going out, which means it can meet its short-term financial obligations. This liquidity is vital for day-to-day operations, ensuring that the company can pay its bills, cover payroll, and handle any unexpected expenses without relying on external financing.

- Accounts Receivable Turnover:

Picture this metric as the speed at which your business collects payments from customers. A high accounts receivable turnover ratio indicates efficient credit management and timely invoice collections. Conversely, a low ratio may signal cash flow challenges or issues with customer creditworthiness.

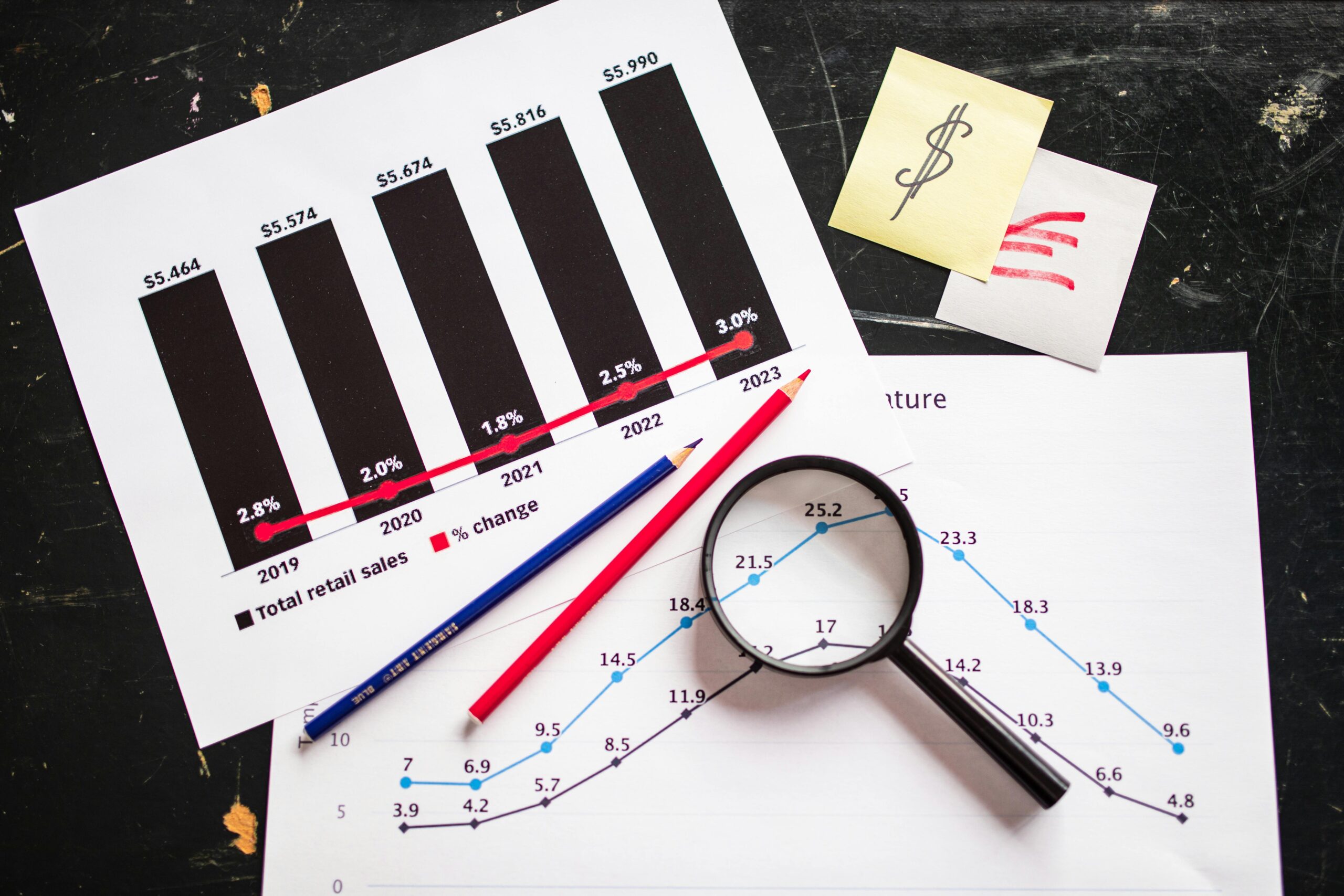

- Revenue and Growth:

It begins with the top line. Total revenue represents your overall income, while the rate of revenue growth illustrates the speed at which your sales are expanding. Comparing your growth to industry averages through benchmarking can uncover your competitive advantage.

- Debt-to-Equity Ratio:

Every business encounters waves of debt, but it’s essential to navigate them wisely. The debt-to-equity ratio measures the proportion of debt financing relative to equity financing in your business. A lower ratio signifies less reliance on borrowed funds, which can enhance financial stability and creditworthiness. The ideal ratio varies by industry, but generally, small businesses aim for a ratio below 2:1.

These are just a few key metrics to keep an eye on. Remember, financial health is a multifaceted concept. Consider consulting with a professional accountant to establish a customized set of metrics tailored to your specific industry and business goals.

By consistently monitoring these financial metrics, you gain valuable insights into your business’s performance, identify potential roadblocks, and make data-driven decisions to optimize your path to success.

So, what metrics are you currently tracking? Share your experiences in the comments below!