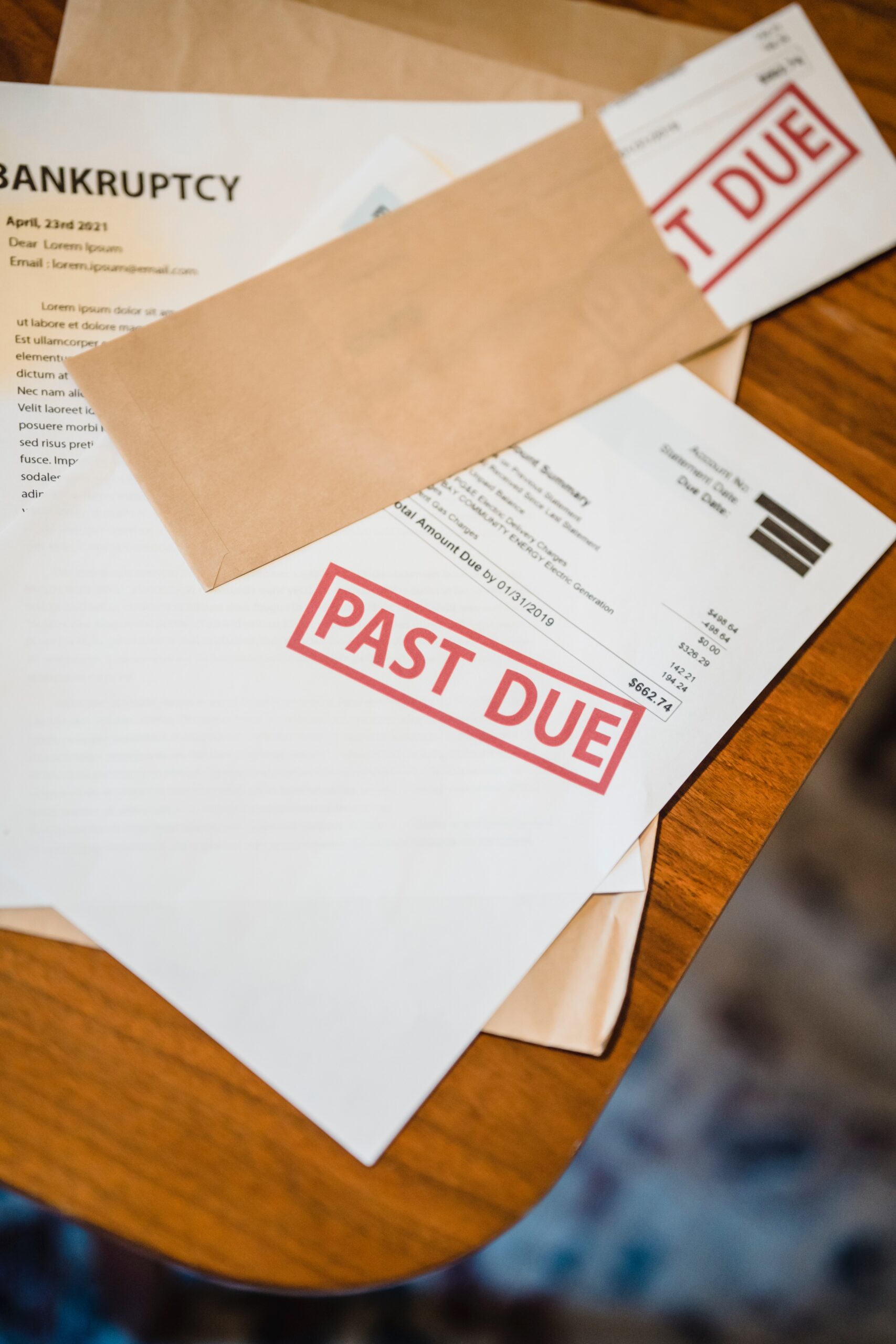

The Impact of Bad Debt on Your Finances

Small business owners face several challenges while handling the operations of their businesses. These include inconsistent cash flow, poor budgeting, not being tax compliant, and not paying bills on time. Bad debt can therefore significantly affect the business’s financial stability.

We will start by understanding bad debt and then delve into its implications on the financial health of small businesses.

Understanding Bad Debt:

Bad debt refers to the unpaid balances from customers or clients that a business is unable to collect despite its best efforts. In simpler terms, it arises when customers fail to make payments for goods or services they have purchased. Irrespective of the reasons why the customers fail to make the payments, excessive bad debt can lead to detrimental consequences for small businesses.

- Effect on Cash Flow:

When customers default on their payments, the business loses out on the expected revenue. This, in turn, hampers the ability to pay suppliers, cover operational expenses, and invest in growth opportunities. Prolonged periods of inconsistent cash flow can severely restrict a small business’s ability to survive and expand.

- Strained Profit Margins:

Bad debts can also eat into a business’s profits, affecting profit margins. To recover the losses incurred due to bad debt, a business may need to increase the prices of its goods or services. However, this may result in losing price-sensitive customers, further impacting revenue. Striking the right balance between protecting profit margins and attracting customers becomes crucial.

- Time and Resources Drain:

Dealing with bad debt requires time and resources that could be better utilized in other aspects of the business. Small businesses often have limited personnel and financial resources, and chasing down bad debts can take away valuable time from core operations. Hiring debt collection agencies or pursuing legal actions against defaulting customers can also add to the financial burden.

- Risk to Business Sustainability:

For a small business, bad debt can pose a significant risk to its sustainability. If left unchecked, a continuous accumulation of bad debt can jeopardize the business’s ability to meet financial obligations, leading to insolvency. This risk can deter potential investors, lenders, and partners from collaborating with the business.

Mitigating the Impact of Bad Debt:

While it is impossible to eliminate bad debt, there are strategies that small businesses can adopt to minimize its impact:

Clear Credit Policies: Implement clear credit policies, conduct credit checks on customers, and set credit limits to reduce the risk of bad debt.

Invoicing Best Practices: Issue invoices promptly and ensure they are accurate and easy to understand. Offer multiple payment options to encourage timely payments.

Effective Communication: Maintain open communication with customers to address any payment issues promptly. Sometimes, customers may be facing financial difficulties and a proactive approach can help in finding a solution.

Debt Collection Strategies: Establish a structured debt collection process and be consistent in following up on overdue payments.

Factoring or Invoice Financing: Consider using factoring or invoice financing services to convert outstanding invoices into immediate cash flow.